论文

Study on the Binary Option Pricing Formula with Regime-Switching

检索正文关键字

论文目录

- 1 Introduction

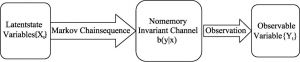

- 2 Hidden Markov Model

- 3 Basic Assumption

-

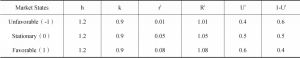

4 The European Call Option Pricing When the Initial Market Situation is Smooth

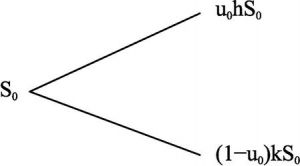

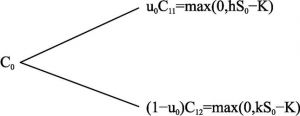

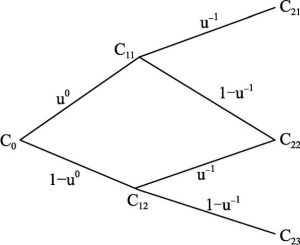

- 4.1 The single-time European call option pricing

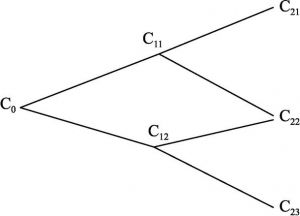

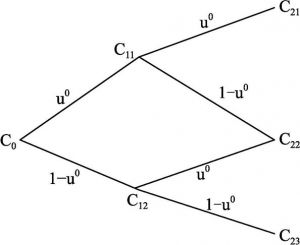

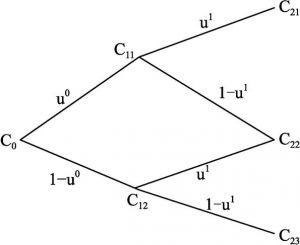

- 4.2 The European call option pricing of second-stage

- 4.3 The pricing formula of n-period European call option

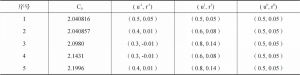

- 5 Comparative Analysis with a Simple Binary Tree Option Pricing Formula

- 6 Conclusions

相关文献

Study on the Binary Option Pricing Formula with Regime-Switching

Exploring Factors Affecting Expenditures on Media

Regulation of Executive Compensation of SOEs: Empirical Evidence from China Stock Market

A Psychographic Study of the Formation Mechanism of Green Purchase Intention among Chinese Consumers

A Study on the Models of Monetary Policy in China

The Economic Growth Model Based on Entrepreneurship Capital

Financial Vulnerability, Inflation and Economic Development in China

Studies on the Pattern of Short-Term Fluctuations in China’s Business Cycles

查看更多>>>