章节

中国地方政府公共财政支出行为和城市预算外土地收入

摘要

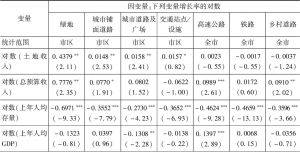

本文提出了一种间接方法来考察地方政府对于土地收入的支出偏好。这种方法对公共部门产出与土地收入进行回归。土地收入是预算外收入的最主要来源。本文采用这种方法能够克服无法获得土地收入的支出数据的问题。实证研究得出的结论是,地方政府更愿意将土地收入用于城市生产性基础设施建设(如城市铺面道路建设),投资于形象工程(如打造开放空间和公共广场)以及有助于加深公众对地方经济增长印象的项目。本文使用1999~2006年中国地级市的面板数据检验了这些假设。回归结果证实了这些假设。

关键词

检索正文关键字

章节目录

- 引言

- 一 文献

-

二 地方政府财政状况和预算外土地收入

- (一)财政状况

- (二)土地制度和土地租赁

- (三)预算外收入和土地收入

- (四)土地收入和城市基础设施

- 三 模型和数据

- 四 实证结果

- 五 结语

相关文献

查看更多>>>