论文

存量流量一致模型在经济和金融危机分析中的研究进展综述

摘要

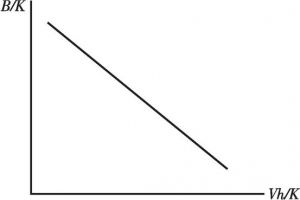

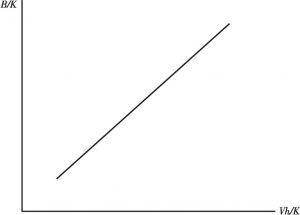

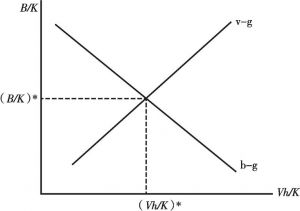

20世纪70年代,以戈德利为首的经济学家创建了存量流量一致模型,将金融系统纳入模型,基于存量流量一致的会计核算原则,借助各部门的行为方程和核算等式闭合模型,考察各个存量、流量的动态互动与均衡,为宏观经济学的研究提供了全新的分析框架。本文对存量流量一致模型在经济危机和金融危机分析中有代表性的研究成果进行了系统分析和评述。本文首先介绍了桑托斯构建的四部门存量流量模型以及两种均衡求解方法,对存量流量一致的理论框架做了简单的梳理;接着阐述了戈德利借助存量流量一致的分析框架分析和预测美国经济危机的系列研究,进而阐述了尼克福斯在前人基础上对收入差距扩大影响经济发展的拓展研究。在对金融危机的分析上,本文主要介绍了对带有明斯基特征的商业周期进行动态分析的相关模型;还介绍了存量流量一致模型中应对经济与金融危机的宏观政策分析,多数研究显示出财政政策的有效性,而逆周期的调节政策对稳定经济更有帮助。最新的存量流量一致模型已经开始尝试与基于行动者建模相结合,这种新的分析框架兼具严谨性与灵活性的特点,论文分析了这些在与金融市场结合研究方面的初步进展。

检索正文关键字

论文目录

- 一 存量流量一致模型的基本分析框架

- 二 基于存量流量一致模型对经济危机的研究进展

- 三 基于存量流量一致模型对金融脆弱性和金融危机的研究文献综述

- 四 存量流量模型中的应对经济和金融危机的政策分析

- 五 存量流量模型在经济和金融危机分析中的最新研究进展

- 六 结论

相关文献

查看更多>>>