论文

Flows and Asset Price: An Empirical Study in Korea

检索正文关键字

论文目录

- 1 Introduction

-

2 Background

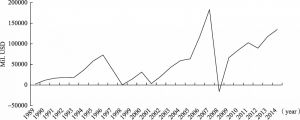

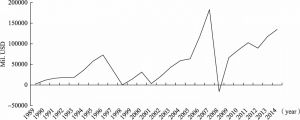

- 2.1 Trends of Capital Flow

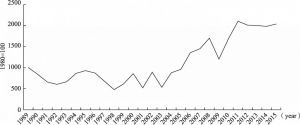

- 2.2 Trends of Asset Prices

- 2.3 Policy Responses

- 3 Literature Review

-

4 Episodes of Surges, Stops, Flights, and Retrenchment

- 4.1 Capital Flows

- 4.2 Direct Investment

- 4.3 Portfolio Investment

- 4.4 Other Investment

-

5 Methodology

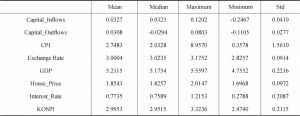

- 5.1 Descriptive Statistics

- 5.2 Empirical Model

- 5.3 Exclusion Restrictions

-

6 Empirical Results

- 6.1 Statistics Summary

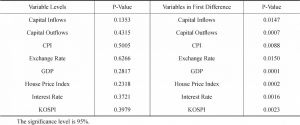

- 6.2 Unit Root Test

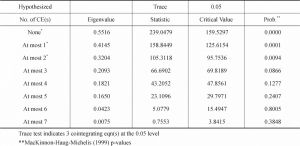

- 6.3 Cointegration Test

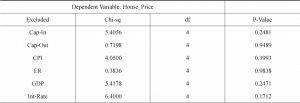

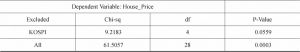

- 6.4 Granger Causality Test

- 6.5 Impulse Responses

- 7 Conclusion

相关文献

the Changes in Business Cycle and Driving Force Conversion in China

Analysis of Nonlinear Dynamic Mechanism of Inflation and Phillips Curve

The Impact of Uncertainty on Japan’s Economy

Relationships Research among Control Mechanism, Cooperation and Suppliers Performance

查看更多>>>