论文

成年居住流动性对风险资产投资期限偏好的影响

摘要

中国城市化进程已具有一定规模,为追求更好的自我发展和居住环境,人口流动已经成为一个不容忽视的社会现象,而成年人正是这种主动流动的主导力量。随着经济的发展,金融资产投资作为经济市场化的重要产物,越来越多的人参与其中。为此,本研究探讨成年居住流动性与投资行为,尤其是与风险资产投资期限偏好的关系。我们通过两个实证研究发现,成年居住流动性越高,风险资产投资期限偏好越短;投资风险容忍度在成年居住流动性与投资期限偏好之间存在显著的间接效应,且具体表现为遮掩效应。本研究揭示了居住流动性对投资行为的影响,深化并充实了居住流动性及投资行为相关的心理模型。希望本研究的结果可以为金融领域的社会心理建设以及培养健康的社会投资心态提供切入点,并为金融安全相关政策的制定提供心理学的依据。

作者

周佳雯 ,中国科学院心理研究所,中国科学院大学心理学系硕士研究生。

李岩梅 ,中国科学院行为科学重点实验室,中国科学院心理研究所副研究员。

Zhou Jiawen

Li Yanmei

检索正文关键字

论文目录

-

一 引言

- (一)研究背景

- (二)成年居住流动性与短期投资期限偏好

- (三)成年居住流动性、风险容忍度与投资期限偏好

- 1.成年居住流动性与风险容忍度

- 2.风险容忍度与投资期限偏好

- 3.成年居住流动性、风险容忍度与投资期限偏好

-

二 研究一:成年居住流动性与计划投资期限偏好

- (一)方法

- (二)测量工具

- (三)假设检验

- (四)讨论

-

三 研究二:成年居住流动性与风险投资期限偏好

- (一)方法

- (二)测量工具

- (三)数据分析和结果

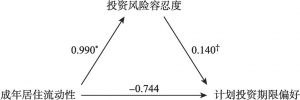

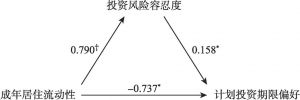

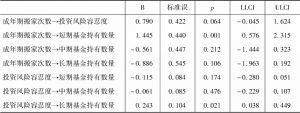

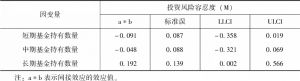

- 1.成年居住流动性、计划投资期限偏好与投资风险容忍度

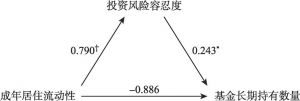

- 2.成年居住流动性、基金持有期限偏好与投资风险容忍度

- (四)讨论

-

四 总讨论

- (一)成年居住流动性与短期投资期限偏好

- (二)成年居住流动性、投资风险容忍度与投资期限偏好

- (三)研究意义

- (四)研究局限与展望

相关文献

查看更多>>>