论文

资本市场开放具有信息治理效应吗?

摘要

基于2008~2018年我国上市公司业绩预告数据,本文从管理层信息披露的角度研究了资本市场开放背景下陆港通交易制度的信息治理效应。结果发现,被选为陆港通标的后,上市公司业绩预告质量得到了提升,说明陆港通交易制度能够在上市公司信息披露中发挥治理作用,并且这一研究结论在经过一系列稳健性检验后依然成立。进一步研究发现,在盈余管理程度高、股权集中度高和高新技术公司中这种作用更显著。研究结论为资本市场开放对公司信息披露的治理效应提供了新的证据,同时也为进一步贯彻实施资本市场开放政策提供了理论依据。

检索正文关键字

论文目录

- 引言

- 1 文献综述

- 2 理论分析与研究假设

-

3 研究设计

- 3.1 样本选择与数据来源

- 3.2 主要变量定义及模型设定

-

4 实证结果

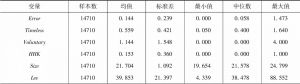

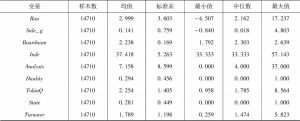

- 4.1 描述性统计

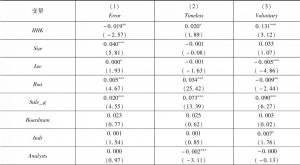

- 4.2 回归结果分析

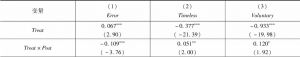

- 4.3 内生性检验

- 4.4 稳健性检验

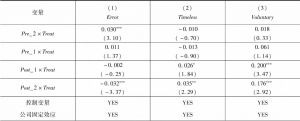

- 4.4.1 平行趋势检验

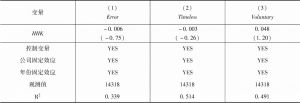

- 4.4.2 安慰剂检验

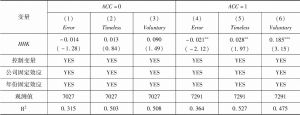

- 5 影响机制分析

- 结论

相关文献

查看更多>>>