章节

动态GTAP理论

检索正文关键字

章节目录

-

2.1 GTAP-Dyn理论

- 2.1.1 介绍

- 2.1.2 资本积累

- 2.1.3 投资理论

- 2.1.3.1 资本供应函数

- 2.1.3.2 资本的实际和预期回报率

- 2.1.4 金融资产及相关收入

- 2.1.4.1 一般特征

- 2.1.4.2 变量命名规则

- 2.1.4.3 资产积累

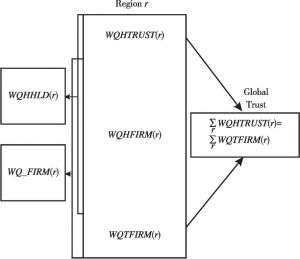

- 2.1.4.4 企业和家庭的资产与负债

- 2.1.4.5 全球信托的资产和负债

- 2.1.4.6 金融资产收入

- 2.1.5 黏性工资机制

- 2.1.5.1 变量处理

- 2.1.5.2 一般性“黏性工资”设定

- 2.1.5.3 特殊“黏性工资”设定

- 2.1.5.4 函数的线性化

- 2.1.5.5 模型闭合的切换

- 2.1.6 模型特性和问题

- 2.1.6.1 累积的和比较的动态结果

- 2.1.6.2 路径依赖

- 2.1.6.3 资本账户波动和储蓄倾向

- 2.1.7 结束语

-

2.2 动态GTAP模型的行为和熵参数

- 2.2.1 引言

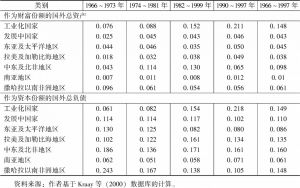

- 2.2.2 决定一个区域财富和资本组成的参数

- 2.2.2.1 参数选取和模型的行为

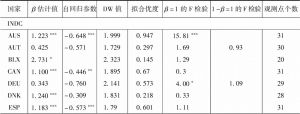

- 2.2.2.2 计量模型和数据

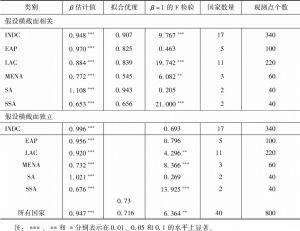

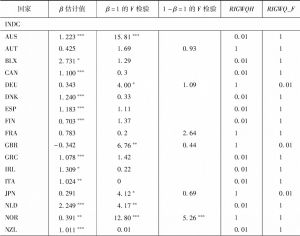

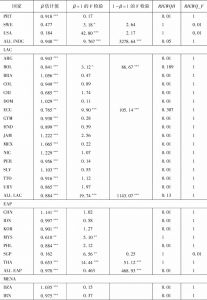

- 2.2.2.3 经验分析结果

- 2.2.2.4 刚性参数

- 2.2.2.5 参数加总的问题

- 2.2.3 结论和总结

-

2.3 动态GTAP数据库概览、数据库的构建和加总程序

- 2.3.1 引言

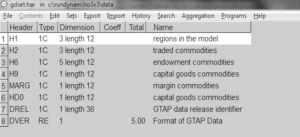

- 2.3.2 GTAP-Dyn数据文件

- 2.3.2.1 收入和储蓄

- 2.3.2.2 区分部门和区域的资本与投资数据

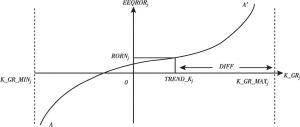

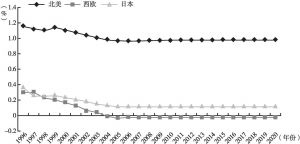

- 2.3.2.3 资本存量的正常增长率TREND_K与投资曲线区间参数DIFF

- 2.3.2.4 历史平均资本回报率(RWACC)

- 2.3.2.5 资本对回报率的弹性(SMURF)

- 2.3.2.6 其他无量纲指数

- 2.3.2.7 黏性工资滞后的调整参数

- 2.3.2.8 刚性参数

- 2.3.3 建立GTAP-Dyn数据库和参数的加总

-

2.4 动态GTAP模型的基准情景

- 2.4.1 简介

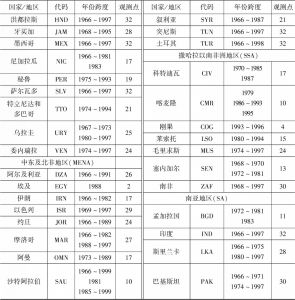

- 2.4.2 宏观经济指标的预测

- 2.4.2.1 指标预测值来源

- 2.4.2.2 缺失数据

- 2.4.3 基准情景中的政策变化

- 2.4.3.1 数据来源

- 2.4.3.2 政策协定

- 2.4.4 实施基准情景

- 2.4.4.1 区域加总

- 2.4.4.2 模型闭合

- 2.4.4.3 中国获得的国外投资

- 2.4.5 结论

-

2.5 用RunDynam软件运行动态GTAP模型

- 2.5.1 简介

- 2.5.2 安装和运行RunDynam软件

- 2.5.2.1 安装RunDynam

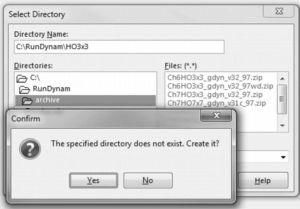

- 2.5.2.2 下载RunDynam应用档案

- 2.5.2.3 打开RunDynam

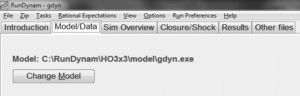

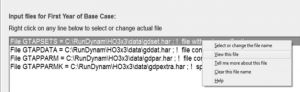

- 2.5.2.4 读取模拟

- 2.5.3 查看数据

- 2.5.4 运行模拟

- 模拟概况

- 闭合/冲击页面

- 运行模拟

- 修改模拟

- 2.5.5 查看结果

- (1)查看所有阶段的结果

- (2)使用ViewSOL查看结果

- (3)查看某些年份的结果

- (4)查看个别时期的结果

查看更多>>>