论文

企业投资决策:“并驾齐驱”还是“迎头赶上”?

摘要

同伴效应并非只是公司间投资决策的盲目跟从。企业不仅有从同伴公司学习和获取信息的需求,还有追赶同伴公司的目标。本文以2009~2018年我国上市公司为样本,以同伴公司的股票回报信息为工具变量,采用两阶段回归法对同伴效应及影响因素进行实证检验。研究发现,我国上市公司的投资决策存在同伴效应,但公司之间的投资决策趋异而非趋同;进一步研究发现,焦点公司的投资决策参考领头公司和领先公司,追赶效应更符合同伴公司间的竞争关系;此外,焦点公司追赶领先公司更有利于提高公司投资绩效和提升公司价值。

检索正文关键字

论文目录

- 引言

-

1 文献综述

- 1.1 同伴效应

- 1.2 追赶效应

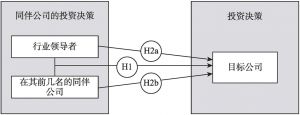

- 2 研究假设

-

3 研究设计

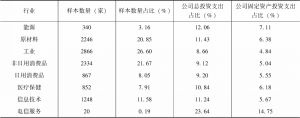

- 3.1 样本选择与数据来源

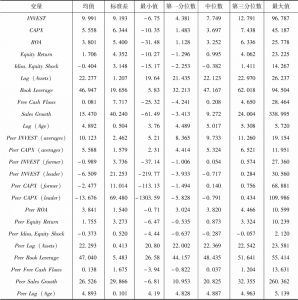

- 3.2 变量的选取与度量

- 3.2.1 被解释变量

- 3.2.2 主要解释变量

- 3.2.3 同伴行为解释变量

- 3.2.4 控制变量

- 3.3 模型设计

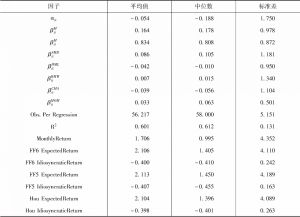

- 3.3.1 股票回报冲击

- 3.3.2 基础回归模型

- 3.3.3 未来绩效回归模型

-

4 实证结果分析

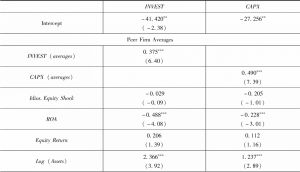

- 4.1 投资同伴效应存在性检验

- 4.1.1 回归结果分析

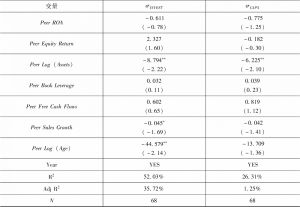

- 4.1.2 内生性检验

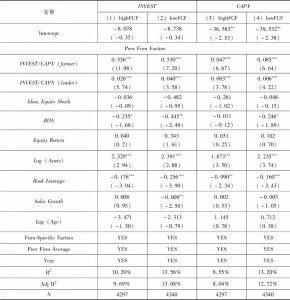

- 4.2 投资同伴效应的异质性检验

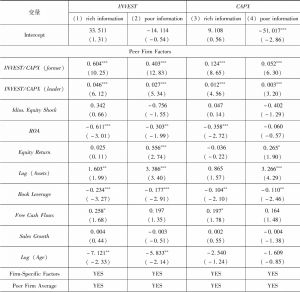

- 4.3 同伴效应的经济效果检验

- 4.4 稳健性检验

- 4.1 投资同伴效应存在性检验

- 结论

查看更多>>>