章节

动态GTAP理论

关键词

作者

刘宇 ,中国科学院科技战略咨询研究院研究员,中国科学院大学岗位教授、博士生导师。研究方向为可持续发展管理、能源经济、气候变化及国际贸易等。

肖敬亮 ,男,深圳英飞咨询有限公司资深经济分析师。2003年获得赫特福德大学计算机硕士学位,2004年获取兰卡斯特大学运筹学硕士学位,2009年在莫纳什大学CoPS中心获取经济学博士学位。

邓祥征 ,中国科学院地理科学与资源研究所研究员(二级)、博士生导师,国家杰出青年基金获得者,陆表环境管理研究室主任、中国科学院农业政策研究中心主任,中国科学院特聘研究员,国家重点研发计划项目负责人。先后从中国科学院研究生院、新西兰沃卡托大学获得遥感与地理信息系统、环境经济学博士学位,长期从事资源管理与政策、环境与生态管理、农林经济管理、区域可持续发展等方面的教学与研究工作。

巴德里·戈帕拉克里希南(Badri Narayanan)

检索正文关键字

章节目录

-

2.1 GTAP-Dyn理论

- 2.1.1 介绍

- 2.1.2 资本积累

- 2.1.3 投资理论

- 一 资本供应函数

- 二 资本的实际和预期回报率

- 2.1.4 金融资产及相关收入

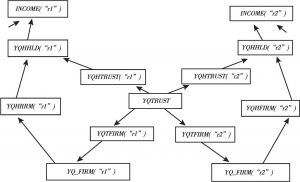

- 一 一般特征

- 二 变量命名规则

- 三 资产积累

- 四 企业和家庭的资产与负债

- 五 全球信托的资产和负债

- 六 金融资产收入

- 2.1.5 黏性工资机制

- 一 变量处理

- 二 一般性“黏性工资”设定

- 三 特殊“黏性工资”设定

- 四 函数的线性化

- 五 模型闭合的切换

- 2.1.6 模型特性和问题

- 一 累积的和比较的动态结果

- 二 路径依赖

- 三 资本账户波动和储蓄倾向

- 2.1.7 结束语

-

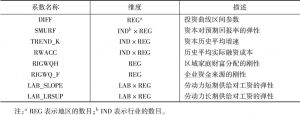

2.2 动态GTAP模型的行为和熵参数

- 2.2.1 引言

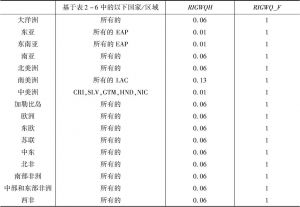

- 2.2.2 决定一个区域的财富和资本组成的参数

- 一 参数选取和模型的行为

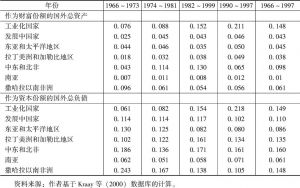

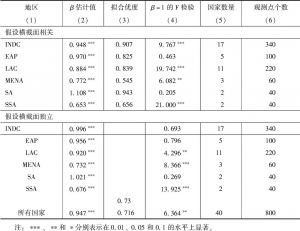

- 二 计量模型和数据

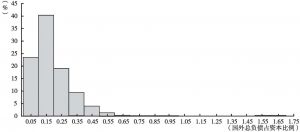

- 三 经验分析结果

- 四 刚性参数

- 五 参数加总的问题

- 2.2.3 结论和总结

-

2.3 动态GTAP数据库概览、数据库的构建和加总程序

- 2.3.1 引言

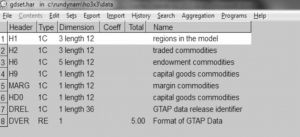

- 2.3.2 GTAP-Dyn数据文件

- 一 收入和储蓄

- 二 区分部门和区域的资本与投资数据

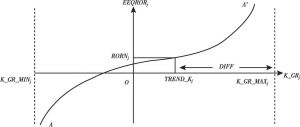

- 三 资本存量的正常增长率TREND_K与投资曲线区间参数DIFF

- 四 历史平均资本回报率(RWACC)

- 五 资本对回报率的弹性(SMURF)

- 六 其他无量纲指数

- 七 黏性工资滞后的调整参数

- 八 刚性参数

- 2.3.3 建立GTAP-Dyn数据库和参数的加总

-

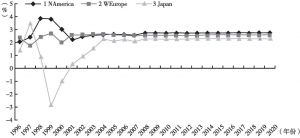

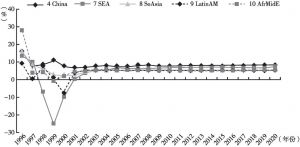

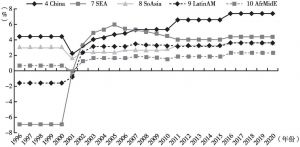

2.4 动态GTAP模型的基准情景

- 2.4.1 简介

- 2.4.2 宏观经济指标的预测

- 一 指标预测值来源

- 二 缺失数据

- 2.4.3 基准情景中的政策变化

- 一 数据来源

- 二 政策协定

- 三 实施基准情景

- 2.4.4 结论

-

2.5 用RunDynam软件运行动态GTAP模型

- 2.5.1 简介

- 2.5.2 安装和运行RunDynam软件

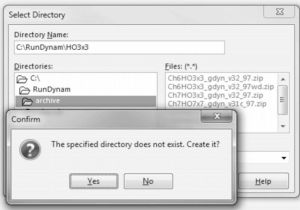

- 一 安装RunDynam

- 二 下载RunDynam应用档案

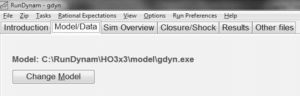

- 三 打开RunDynam

- 四 读取模拟

- 2.5.3 查看数据

- 2.5.4 运行模拟

- 2.5.5 查看结果

- (1)查看所有阶段的结果

- (2)使用ViewSOL查看结果

- (3)查看某些年份的结果

- (4)查看个别时期的结果

相关文献

查看更多>>>