论文

推广的高阶CAPM理论模型及其实证检验

摘要

本文设投资者的效用函数可由n阶泰勒展开式近似表达,在此基础上构建的推广的高阶CAPM理论模型显示,当风险资产市场达到均衡点(不动点)时,投资的净效用与市场组合收益率的1阶矩、2阶矩、3阶矩、……、n阶矩有关。同一时刻不同风险资产的预期收益率差异由其收益率与市场组合收益率、市场组合收益率的2次方、……、市场组合收益率的(n-1)次方的协方差的差异共同决定。选择兼具期货和现货投资基础的沪深300指数、上证50指数、中证500指数进行实证检验,结果发现,投资者投资某一资产组合的效用受到资产组合收益率1阶矩的正向影响、2阶矩的负向影响、3阶矩的正向影响、4阶矩的负向影响,由此逐一验证了标准偏好的四个性质:不满足、风险厌恶、绝对风险厌恶递减(审慎)、绝对审慎递减(克制)。

作者

夏仕龙 (1989- ),男,四川大学经济学院副研究员,硕士研究生导师,经济学博士,研究方向为货币理论与政策。

Xia Shilong

检索正文关键字

论文目录

- 引言

- 1 推广的高阶CAPM理论模型

-

2 实证检验

- 2.1 回归模型

- 2.2 样本和数据

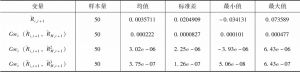

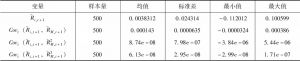

- 2.3 描述性统计

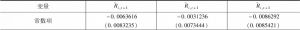

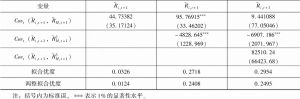

- 2.4 回归结果

- 2.5 经济学解释

- 3 结论

相关文献

查看更多>>>