论文

国内股市与汇市的市场不确定性存在跨市场效应吗?

摘要

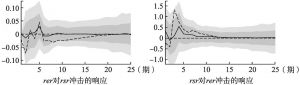

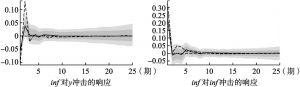

以价格波动率表征市场不确定性,本文通过构造基于异质性交易者模型和运用SVAR-H-SV模型分别从理论和实证角度分析了股市和汇市间市场不确定性的跨市场效应。研究发现:理论上股市和汇市的市场不确定性主要通过基本面渠道和风险规避渠道产生跨市场效应。样本期内,市场不确定性的跨市场效应主要通过交易者的风险规避渠道传导,汇市波动率上升在短期内会显著地推动股价上涨,但股市波动率对汇率的贬值效应并不显著。最后,提出加强资本流动管理和完善汇率形成机制的政策建议。

作者

刘林 ,太原理工大学经济管理学院副教授、硕士生导师。研究方向为计量经济模型及其应用。

检索正文关键字

论文目录

- 引言

-

1 理论分析与实证模型框架

- 1.1 理论分析

- 1.国内股市

- 2.外汇市场

- 3.市场基本面价值

- 4.动态系统

- 1.2 实证模型框架

- 1.1 理论分析

-

2 实证研究过程与结果分析

- 2.1 数据选取与数据初步处理

- 2.2 描述性统计与单位根检验

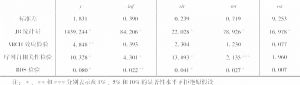

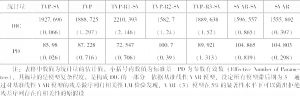

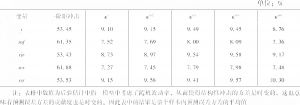

- 2.3 VAR模型比较与选择

- 2.4 VAR(3)-H(1)-SV模型回归与结果分析

- 3 结论与政策建议

相关文献

查看更多>>>