论文

短期资本流动、经济政策不确定性与恐慌指数

摘要

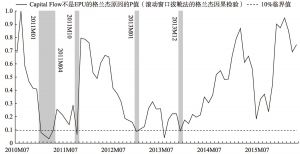

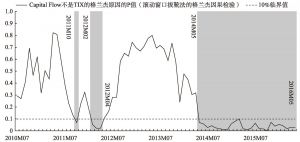

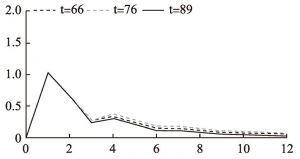

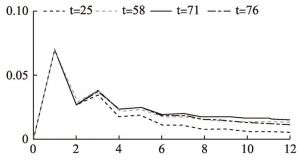

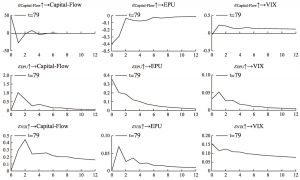

本文在时变分析框架内对我国的短期资本流动、经济政策不确定性以及恐慌指数之间的动态关系进行研究。基于滚动窗口拔靴方法的格兰杰因果检验的结果表明:短期资本流动与经济政策不确定性之间存在时变的格兰杰因果关系,而2015年“股灾”期间,投资者由于“羊群效应”,使得经济政策不确定性不是短期资本流动的格兰杰原因;短期资本流动是恐慌指数的单向格兰杰因果关系,而经济政策不确定性与恐慌指数之间存在双向的格兰杰因果关系。随后,我们建立TVP-VAR模型,并利用等时间间隔的脉冲响应函数以及时点脉冲响应函数分析了三个变量的动态调整路径。研究结果表明,近年来,我国经济政策对短期资本流动的影响由“被动调节”转为“主动引导”。此外,由于我国资本账户尚未完全开放,国际资本市场的金融恐慌对我国短期资本流动的影响较小。相反,由于我国经济不断发展,短期资本流动已经成为影响国际金融恐慌的重要原因。

作者

蔡一飞 (1991-),男,东北师范大学经济学院硕士研究生,主要研究方向为宏观计量经济学、应用计量经济学。

检索正文关键字

论文目录

- 引言

- 1 文献综述

-

2 实证模型的建立

- 2.1 基于滚动窗口拔靴法的格兰杰因果关系检验

- 2.2 TVP-VAR模型的建立

-

3 数据与实证结果

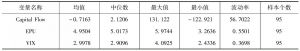

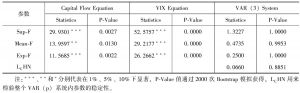

- 3.1 参数稳定性检验

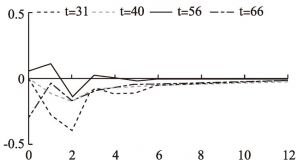

- 3.2 基于滚动窗口拔靴法的格兰杰因果检验

- 3.3 TVP-VAR模型的实证结果

- 3.3.1 等时间间隔脉冲响应时变特征分析

- 3.3.2 时点脉冲响应时变特征分析

- 4 结论

相关文献

查看更多>>>