章节

经济改革日程的短期效应

关键词

作者

张莹 ,任职于西澳大学商学院经济系。

检索正文关键字

章节目录

- 一 引言

-

二 中国的转型:重要改革的动机

- (一)储蓄

- (二)家庭储蓄

- (三)公司储蓄

- (四)政府储蓄

- (五)经常性账户余额

- 三 国际化和私人金融资金流的新角色

- 四 对实际汇率的特殊敏感性

-

五 中国经济的一个垄断模型

- (一)模型结构

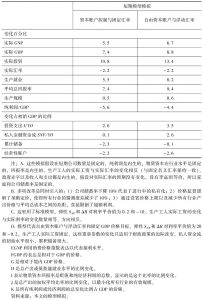

- 1.宏观经济表现

- 2.实际模型中的短期效果

- 3.垄断供给

- (二)基础数据及其所代表的中国经济结构

- (一)模型结构

- 六 进一步的产业改革与短期增长

- 七 资本账户自由化

- 八 结论

相关文献

查看更多>>>