论文

资产误定价、融资约束与股权质押

摘要

本文使用2007~2018年沪深A股上市公司的股权质押数据,以股权质押的影响因素为切入点,探讨资本市场错误定价对控股股东股权质押决策的影响,并考察不同融资约束程度下资本市场错误定价对控股股东股权质押决策影响的差异性。研究发现,当股价被高估时,控股股东股权质押积极性增强,质押规模扩大;反之,控股股东股权质押积极性明显减弱,倾向缩减质押规模。进一步检验发现,控股股东股权质押积极性和质押规模随着股价被高估水平的提高而显著增强和扩大。对于高程度融资约束公司来说,错误定价对控股股东股权质押意愿和质押规模存在显著的负向影响,且这种负向影响随着公司融资约束程度的提高而加大;对于低程度融资约束公司来说,错误定价对控股股东股权质押决策并不存在显著影响。这对于进一步探讨股权质押的经济后果,防控股权质押风险、规范大股东行为、完善公司治理机制具有重要的指导意义。

作者

马德水 ,男,博士,郑州航空工业管理学院商学院讲师。

张敦力 ,男,中南财经政法大学会计学院教授,博士研究生导师。

Deshui Ma

Dunli Zhang

检索正文关键字

论文目录

- 一、引言

-

二、理论分析与研究假设

- (一)资产误定价与股权质押

- (二)资产误定价、融资约束与股权质押

-

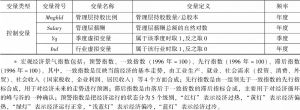

三、研究设计

- (一)样本选取与数据来源

- (二)模型设定与变量定义

- 1.模型设定

- 2.资产误定价估计模型

- 3.融资约束

-

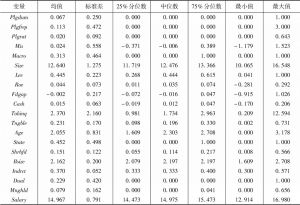

四、实证分析

- (一)描述性统计

- (二)单变量比较检验

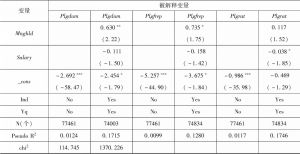

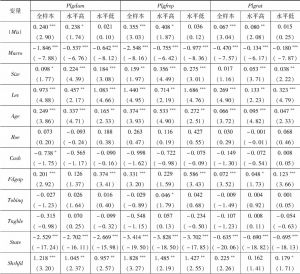

- (三)回归结果分析

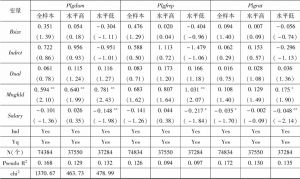

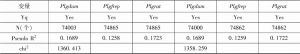

- 1.资产误定价与股权质押

- 2.资产误定价与股权质押:依据资产误定价水平分组

- 3.资产误定价、融资约束与股权质押

- 五、稳健性检验

-

六、研究结论与启示

- (一)研究结论

- (二)研究启示

查看更多>>>