论文

长幼有序、董事权力的合法性与董事会治理效率

摘要

本文从现金持有视角考察了长幼有序文化对董事会治理的影响。我们发现,比公司最高管理者年长的董事比例增加降低了公司现金持有水平和超额现金持有水平,这种影响在儒家文化影响力较大的地区、董事会稳定性较强、董事会规模较大、国有控股、董事长与CEO两职分离的公司中更加明显;进一步研究还发现,年龄比公司最高管理者大的董事比例增加可以提高现金持有和超额现金持有的价值,且其作用在儒家文化影响力较大的地区、董事会稳定性较强、董事会规模较大、国有控股、董事长与CEO两职分离的公司中更加明显;相比独立董事,非独立董事比公司最高管理者年长能够更明显地降低公司现金持有水平和超额现金持有水平,提高现金持有和超额现金持有的价值。本文的证据表明,董事与公司管理者间的年龄关系通过影响他们间的权威结构,能够影响董事会治理效率。

检索正文关键字

论文目录

- 一、引言

- 二、理论分析与研究假设

-

三、研究设计

- (一)回归模型

- (二)样本选择与数据描述

-

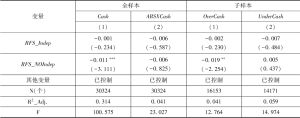

四、回归结果

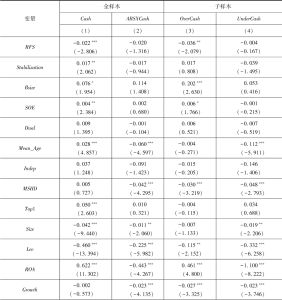

- (一)基本回归结果

- (二)稳健性测试

- 1.进一步控制公司最高管理者(董事长)的年龄

- 2.控制公司固定效应

- 3.使用上一期的RFS

- 4.工具变量两阶段回归

- (三)进一步研究

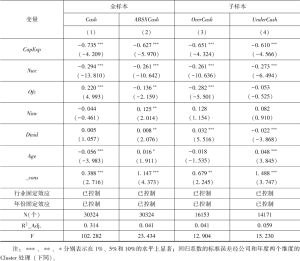

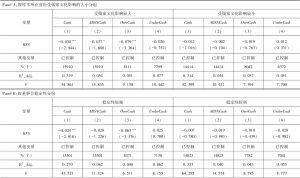

- 1.截面差异分析

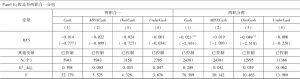

- 2.区分独立董事和非独立董事

- 3.现金持有价值

- 五、结论和意义

相关文献

查看更多>>>