章节

金融周期对自然利率的影响

摘要

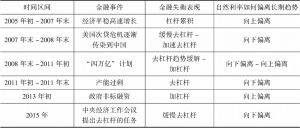

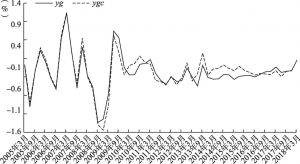

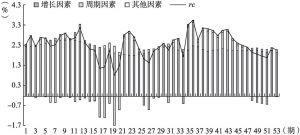

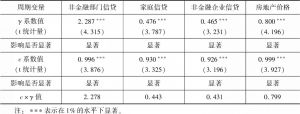

本文以Krustev(2018)的框架为基础,在自然利率的估算中加入金融周期因子,构建状态空间模型,对中国的自然利率进行估算,并考察金融失衡对自然利率的影响。研究发现,金融周期因子对自然利率有显著影响,表征为金融加杠杆和去杠杆的金融失衡都会使自然利率偏离其长期趋势。通过分析产出缺口的估计结果发现,产出缺口受金融周期的显著影响,金融杠杆率越高产出缺口越大,相应的趋势产出越低。同时,自然利率还受风险溢价、政策不确定性的显著影响,但全球储蓄对中国自然利率的影响不显著。

检索正文关键字

章节目录

- 一 引言

- 二 文献综述

-

三 模型构建

- (一)模型构建

- (二)估计方法

- 1.测量方程

- 2.转移方程

-

四 数据描述、估计结果与分析

- (一)数据描述

- (二)自然利率的估计结果

- (三)产出缺口估计

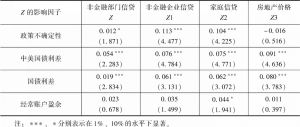

- (四)自然利率的影响因素

- 五 稳健性检验

- 六 结论

相关文献

查看更多>>>