论文

Reinforcement Learning in Repeated Portfolio Decisions

检索正文关键字

论文目录

- 1 Introduction

-

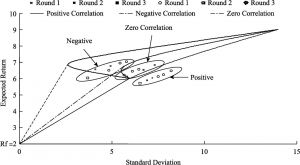

2 The Reinforcement Learning Models

- 2.1 Basic Reinforcement Learning Model

- 2.2 Reinforcement Learning Representing Return,Risk,and Correlation

-

3 Experiment No.1

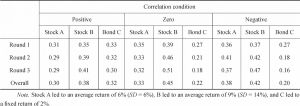

- 3.1 Method

- Participants

- Procedure

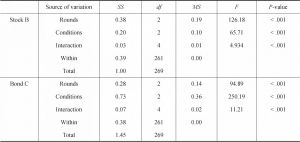

- 3.2 Results

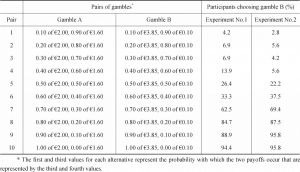

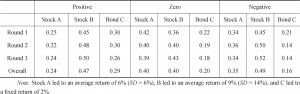

- 1.Risk attitude

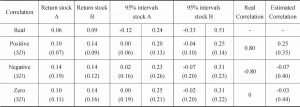

- 2.The MV model’s prediction and investment decisions

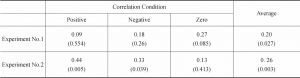

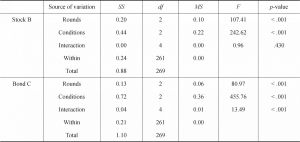

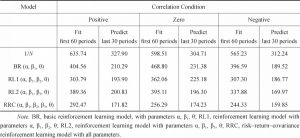

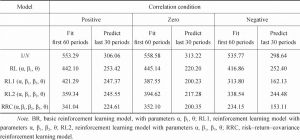

- 3.The learning models

- 3.3 Summary of Experiment No.1

- 3.1 Method

-

4 Experiment No.2

- 4.1 Methods

- 1.Participants

- 2.Procedure

- 4.2 Results

- 1.Risk attitude

- 2.Comparison with the MV model’s prediction

- 3.Comparison of the two experiments

- 4.The learning models

- 4.2 Summary of Experiment No.2

- 4.1 Methods

- 5 General Discussion

-

Appendix (Not for publication)

- Instructions for Experiment No.1

- Part I Portfolio Decision Making

- Part II Gamble Choices

相关文献

The Driving Effect of Environmental Responsibility on Green Consumption Behavior in China

A Research on the Method of Fine Granularity Webpage Data Extraction of Open Access Journals

Education Promote or Hinder Job Mobility?

The Impact of Comparability of Accounting Information on M&A Target Selection

查看更多>>>