摘要

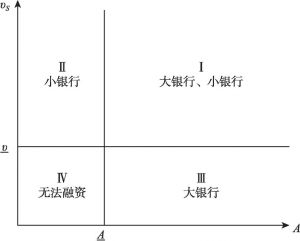

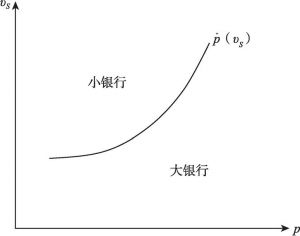

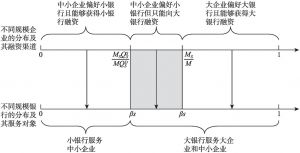

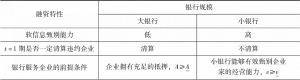

相对于规模较小的银行,大银行在甄别软信息(如企业家经营能力)方面不具有比较优势,大银行为了防范企业家风险,需要严格要求企业的抵押品数量并施行严格的违约清算。大银行的这种融资特性决定了其难以为中小企业提供有效的金融支持,但能帮助大企业有效地节约信息成本、减少利息支出,大银行的融资特性与大企业的企业特性相互匹配。要从根本上缓解中小企业的融资约束,关键在于改善银行业结构,满足中小企业对中小银行的金融需求,发挥中小银行善于甄别企业家经营能力的比较优势,而不是通过行政干预要求大银行服务中小企业。在金融监管方面,由于不同规模银行的融资特性以及适合的融资对象皆存在系统性差异,对不同规模银行的监管也应当有所区别和侧重。

作者

张一林 ,中山大学管理学院副教授、博士生导师,中山大学高级金融研究院新结构金融学研究中心主任。

林毅夫 ,北京大学新结构经济学研究院院长、教授、博士生导师。

龚强 ,中南财经政法大学文澜学院院长、教授、博士生导师,北京大学数字金融研究中心特聘研究员。

- [1]龚强、张一林、林毅夫:《产业结构、风险特性与最优金融结构》,《经济研究》2014年第4期。

- [2]林毅夫:《新结构经济学——重构发展经济学的框架》,《经济学(季刊)》2010年第1期。

- [3]林毅夫、姜烨:《发展战略、经济结构与银行业结构:来自中国的经验》,《管理世界》2006b年第1期。

- [4]林毅夫、姜烨:《经济结构、银行业结构与经济发展——基于分省面板数据的实证分析》,《金融研究》2006a年第1期。

- [5]林毅夫、孙希芳:《银行业结构与经济增长》,《经济研究》2008年第9期。

- [6]林毅夫、孙希芳、姜烨:《经济发展中的最优金融结构理论初探》,《经济研究》2009年第8期。

- [7]徐高、林毅夫:《资本积累与最优银行规模》,《经济学(季刊)》2008年第2期。

- [8]张一林、龚强、荣昭:《技术创新、股权融资与金融结构转型》,《管理世界》2016年第11期。

- [9]Berger,A.N.,and Black,L.K.,“Bank Size,Lending Technologies and Small Business Finance”,Journal of Banking and Finance,35(3),2011:724-735.

- [10]Berger,A.N.,and Udell,G.F.,“Relationship Lending and Lines of Credit in Small Firm Finance”,Journal of Business,68(3),1995:351-381.

- [11]Berger,A.N.,and Udell,G.F.,“Small Business Credit Availability and Relationship Lending:The Importance of Bank Organizational Structure”,Economic Journal,112(477),2002:32-53.

- [12]Berger,A.N.,and Udell,G.F.,“The Economics of Small Business Finance:the Role of Private Equity and Debt Markets in the Financial Growth Cycle”,Journal of Banking and Finance,22(6),1998:613-673.

- [13]Berger,A.N.,Miller,N.H.,Petersen,M.A.,Rajan,R.G.,and Stein,J.C.,“Does Function Follow Organizational Form? Evidence from the Lending Practices of Large and Small Banks”,Journal of Financial Economics,76(2),2005:237-269.

- [14]Berger,A.N.,Saunders,A.,Scalise,J.M.,and Udell,G.F.,“The Effects of Bank Mergers and Acquisitions on Small Business Lending”,Journal of Financial Economics,50(2),1998:187-229.

- [15]Bolton,P.,and Freixas,X.,“Equity,Bonds,and Bank Debt:Capital Structure and Financial Market Equilibrium under Asymmetric Information”,Journal of Political Economy,(2),2000:324-351.

- [16]Cole,R.A.,Goldberg,L.G.,and White,L.J.,“Cookie Cutter vs.Character:The Micro Structure of Small Business Lending by Large and Small Banks”,Journal of Financial and Quantitative Analysis,39(2),2004:227-251.

- [17]Demirgüç-Kunt,A.,and Levine,R.,Financial Structure and Economic Growth:A Cross-Country Comparison of Banks,Markets,and Development?(Cambrige,MA:MIT Press,2001).

- [18]Demirgüç-Kunt,A.,and Maksimovic,V.,“Funding Growth in Bank-Based and Market-Based Financial Systems:Evidence from Firm Level Data”,Journal of Financial Economics,65(3),2002:337-363.

- [19]Diamond,D.W.,“Financial Intermediation and Delegated Monitoring”,Review of Economic Study,51(3),1984:393-414.

- [20]Gollin,D.,“Nobody’s BusinessBut My Own:Self-Employment and Small Enterprise in Economic Development”,Journal of Monetary Economics,55(2),2007:219-233.

- [21]Jayaratne,J.,and Wolken,J.D.,“How Important Are Small Banks to Small Business Lending? New Evidence from a Survey of Small Firms”,Journal of Banking and Finance,23(2),1999:427-458.

- [22]Krasa,S.,and Villamil,A.P.,“Monitoring the Monitor:An Incentive Structure for A Financial Intermediary”,Journal of Economic Theory,57(1),1992:197-221.

- [23]Levine,R.,“Bank-Based or Market-Based Financial Systems:Which is Better?”,Journal of Financial Intermediation,11(4),2002:398-428.

- [24]Levine,R.,“Finance and Growth:Theory and Evidence”,2005.

- [25]Liberti,J.M.,and Mian,A.R.,“Estimating the Effect of Hierarchies on Information Use”,Review of Financial Studies,22(10),2009:4057-4090.

- [26]Lin,J.Y.,Sun,X.,and Jiang,Y.,“Endowment,Industrial Structure and Appropriate Financial Structure:A New Structural Economics Perspective”,Journal of Economic Policy Reform,16(2),2013:1-14.

- [27]McFadden,R.L.,“Optimal Bank Size from the Perspective of Systemic Risk”,Working Paper,2005.

- [28]Mckinnon,R.,Money and Capital in Economic Development(Washington,DC:Brooking Institution,1973).

- [29]Nakamura,L.I.,“Small Borrowers and the Survival of the Small Bank:Is Mouse Bank Mighty or Mickey”,Business Review,December/November,1994:3-15.

- [30]Peek J.,and Rosengren,E.S.,“Bank Consolidation and Small Business Lending:It’s Not Just Bank Size that Matters”,Journal of Banking and Finance,22(6),1998:799-819.

- [31]Petersen,M.A.,“Information:Hard and Soft,” NBER Working Paper,2004.

- [32]Saunders,A.,Strock,E.,and Travlos,N.G.,“Ownership Structure,Deregulation,and Bank Risk Taking”,The Journal of Finance,45(2),1990:643-654.

- [33]Schere,F.M.,Industrial Market Structure and Economic Performance(Chicago:Rand McNally and Company,1971).

- [34]Shaw,E.,Financial Deepening in Economic Development(Oxford University Press,1973).

- [35]Stein,J.C.,“Information Production and Capital Allocation:Decentralized versus Hierarchical Firms”,The Journal of Finance,57(5),2002:1891-1921.

- [36]Strahan,P.E.,and Weston,J.P.,“Small Business Lending and the Changing Structure of the Banking Industry”,Journal of Banking and Finance,22(6),1998:821-845.