论文

A Study on the Nonlinear Correlation between the Chinese and US Business Cycles and the Monetary Policy Rule

检索正文关键字

论文目录

- 1 Introduction

-

2 Theoretical Analysis and Literature Review

- 2.1 Literature Review

- 2.2 Theoretical Framework

-

3 Re-Estimation of Nonlinear Taylor Rule for China and the US

- 3.1 A Taylor Rule Model Accounting for Interest Rate Smoothing

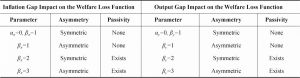

- 3.2 Application of Multiple Threshold Model to the Expanded Taylor Rule

- 3.2.1 Data Processing

- 3.2.2 Estimating the Multiple Threshold Taylor Rule Model

- 3.2.3 Estimating the Multiple Threshold Taylor Rules Model for China and the US

-

4 A Dynamic Empirical Analysis by LT-TVP-VAR Model

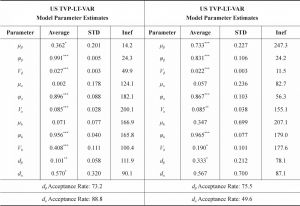

- 4.1 Estimating the Parameter for the LT-TVP-VAR Model

- 4.2 LT-TVP-VAR Based on the New Keynesian Rational Expectations Framework

- 5 Conclusions

相关文献

A Study of Auditing Quality of Branch Offices in the Auditing Market

The Impact of Gambling Behavior on Dividend Payout Policy: Evidence from Taiwan

The Value Relevance of Earnings and Accruals

Global Diversification and Firms’ Stock Market Performance: Do Situational Factors Matter?

Money Market Effect of Open Market Operations: Evidence from China

The Influence of Enterprise Safety Climate on the Safety Behavior of Migrant Workers

查看更多>>>