论文

Dual-pillar Framework for Monetary and Macroprudential Policy: An Analysis Based on TVP-FAVR and MF-VAR Models

检索正文关键字

论文目录

- Introduction

- 1 Literature Review and Research Development

-

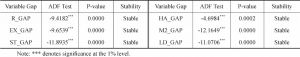

2 Constructing the Model

- 2.1 The TVP-FAVAR Model

- 2.2 The MF-VAR Model

-

3 The Dilemma of Monetary Policy and the Dual-pillar Framework

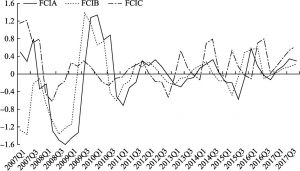

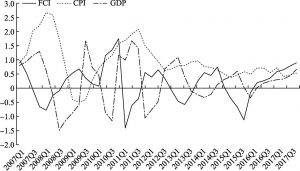

- 3.1 The Measurement and Calculation of the FCI for China

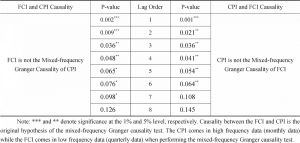

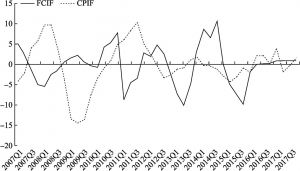

- 3.2 Correlation Analysis for the FCI and CPI

- 4 Conclusions and Discussion

相关文献

A Study of Auditing Quality of Branch Offices in the Auditing Market

The Impact of Gambling Behavior on Dividend Payout Policy: Evidence from Taiwan

The Value Relevance of Earnings and Accruals

Global Diversification and Firms’ Stock Market Performance: Do Situational Factors Matter?

Money Market Effect of Open Market Operations: Evidence from China

The Influence of Enterprise Safety Climate on the Safety Behavior of Migrant Workers

查看更多>>>