论文

The Value Relevance of Earnings and Accruals

检索正文关键字

论文目录

-

1 Introduction

- 1.1 Background

- 1.2 Preview Studies

-

2 Theoretical Framework and Hypotheses Development

- 2.1 Earnings and Accruals Decomposing

- 2.2 Price and Return Model Theoretical Analysis

- 2.3 Hypotheses Development

-

3 Empirical Research Design

- 3.1 Price and Return Models

- 3.2 Variable Definition

- 3.3 Sample Selection

-

4 Empirical Results

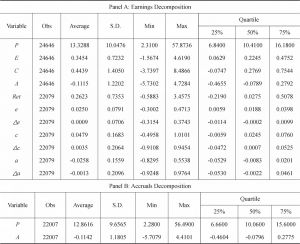

- 4.1 Descriptive Statistics

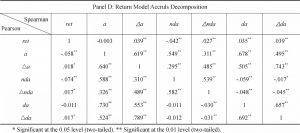

- 4.2 Correlations Analysis

- 4.3 Regression Analysis

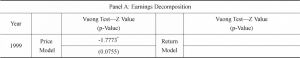

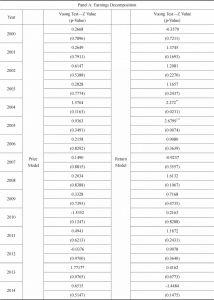

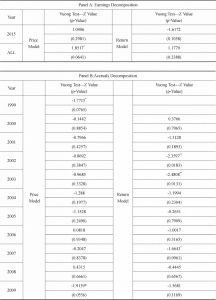

- 4.3.1 Vuong Test

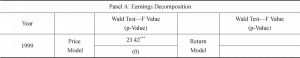

- 4.3.2 Wald Test

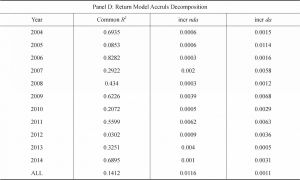

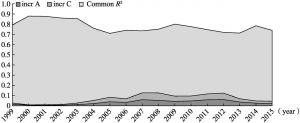

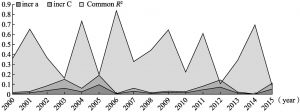

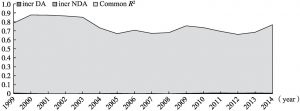

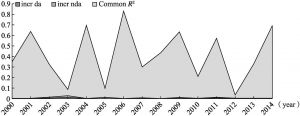

- 4.3.3 Decomposition of R2

- 4.4 Robustness Tests

- 5 Conclusions

相关文献

A Study of Auditing Quality of Branch Offices in the Auditing Market

The Impact of Gambling Behavior on Dividend Payout Policy: Evidence from Taiwan

The Value Relevance of Earnings and Accruals

Global Diversification and Firms’ Stock Market Performance: Do Situational Factors Matter?

Money Market Effect of Open Market Operations: Evidence from China

The Influence of Enterprise Safety Climate on the Safety Behavior of Migrant Workers

查看更多>>>