论文

Money Market Effect of Open Market Operations: Evidence from China

检索正文关键字

论文目录

- 1 Introduction

- 2 Literature Review

-

3 Empirical Specification

- 3.1 Data

- 3.2 Specification

-

4 Results

- 4.1 Basic Results

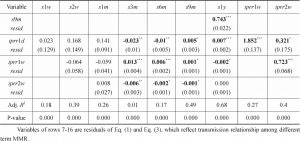

- 4.2 Results of Introducing Transmission Relationship among MMRs

- 5 Conclusions

相关文献

A Study of Auditing Quality of Branch Offices in the Auditing Market

The Impact of Gambling Behavior on Dividend Payout Policy: Evidence from Taiwan

The Value Relevance of Earnings and Accruals

Global Diversification and Firms’ Stock Market Performance: Do Situational Factors Matter?

Money Market Effect of Open Market Operations: Evidence from China

The Influence of Enterprise Safety Climate on the Safety Behavior of Migrant Workers

查看更多>>>